The Human Safety Net and UNICEF partnered to design and promote financial education for parents, providing a new level of support for vulnerable families.

The new project is based on a study carried out by Aflatoun International, which reviewed financial education elements in 25 existing programmes for parents of young children, taking place in 20 countries with different income levels around the world.

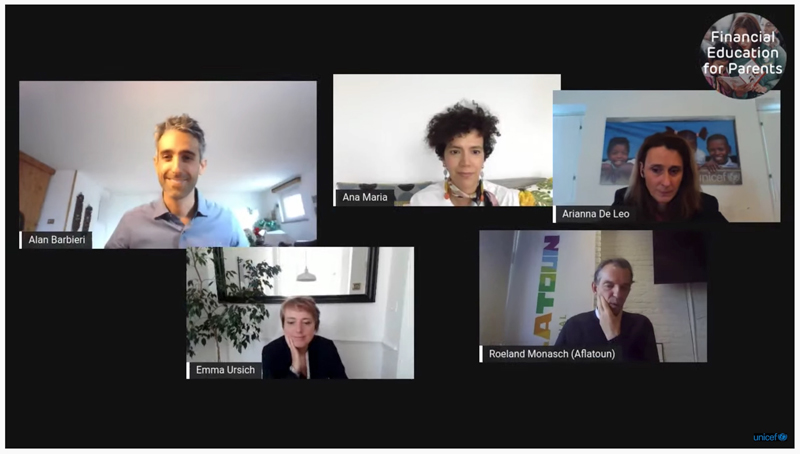

At a webinar to launch the Aflatoun study, Emma Ursich, The Human Safety Net’s Executive Officer explained that there was currently almost no cross-over between existing parenting education programmes and financial education programmes.

Ursich said: “Typically in parenting programmes you have information delivered about health, nutrition and care-giving, but not a lot about finance. But finance is a really important element in strengthening families, even more so after Covid, with statistics showing that that the pandemic has forced more than 150 million children below the poverty line.”

She continued: “Moreover, the financial literacy programmes that exist are generally not geared towards the most vulnerable in society. And as a financial services company, this new project is very close to what a lot of our people at Generali are doing every day for our customers.”

The aim is to integrate financial education into The Human Safety Net For Families programme, using the expertise of Generali’s employees.

Ana-Maria Rodriguez, an Early Childhood Development Specialist at UNICEF, told the webinar: “A major stressor for parents is the issue of finance, both the lack of it or because they are facing a sudden crisis such as the covid pandemic. This hampers the way parents are able to take care of their children, so affecting their overall development. That is why this new initiative is a priority for UNICEF.”

Roeland Monasch, CEO of Aflatoun International, explained that financial education for parents of young children helped them improve their management of resources to care for their children.

Monasch said: “A key finding of our study was that in almost all the programmes we looked at, there was a clear positive impact. These included benefits such as children being more likely to have access to learning materials; being less likely to be spanked by their parents; a decrease in babies being placed in institutions, improved child health and emotional wellbeing, and a reduced risk of families being separated. Combining financial education with Early Childhood Development parenting programmes works!”

Finally, Arianna de Leo, UNICEF Head of Leadership Giving said that there also needed to be a focus on higher-income countries, where inequality is also increasing. “Absolute poverty is sharply rising in Italy, for example, and households with children have been worst affected. Evidence suggests increases in food insecurity; many families report difficulty in paying bills; and a particular need is educational poverty. So financial education is a very powerful tool to help families face this crisis.”

The study can be downloaded here.